1 year of startup building, exponential growth & the road to profitability

One year ago, I took a leap of faith.

I left the comfortable, familiar, and stable corporate world and set out to build the crazy rocketship that is Rabbit.

And before I know it, year has gone by. One minute it feels like it was all a couple of weeks go, and the next I can’t believe it’s ONLY been one year – because it feels like ten! It’s a simultaneous mix of amazement at how much we’ve accomplished, and reflection on how exciting – and exhausting it’s been.

And I wouldn’t have it any other way.

I remember our first few meetings. We had a clear vision from the get-go: Rabbit would reinvent retail, delivering an unprecedented experience powered by top notch tech and world class operational excellence.

I also remember how daunting it all seemed back then. It all sounds great until you need to figure out how to transform that vision into a reality for your prospective customers. I was used to a different way of work in my 20+ years of experience at huge corporations. Everything was super structured. Everyone had a predefined scope within a well established workflow. All anyone needed was to just do their part well, and it would all fall into place.

I didn’t realize how much I took that for granted. At Rabbit, we were building everything from the ground up, literally and figuratively: objectives, processes, workflows as well as teams, fulfillment centers, delivery riders, you name it. Every task felt like a mountain to scale. In theory, everything had a thousand and one ways where it could go wrong, but when it didn’t, the joy we felt was immeasurable. Every tiny detail felt like a milestone and cause for celebration: signing our first micro fulfillment center lease, receiving our first batch of stocks, delivering our first customer order,….etc.

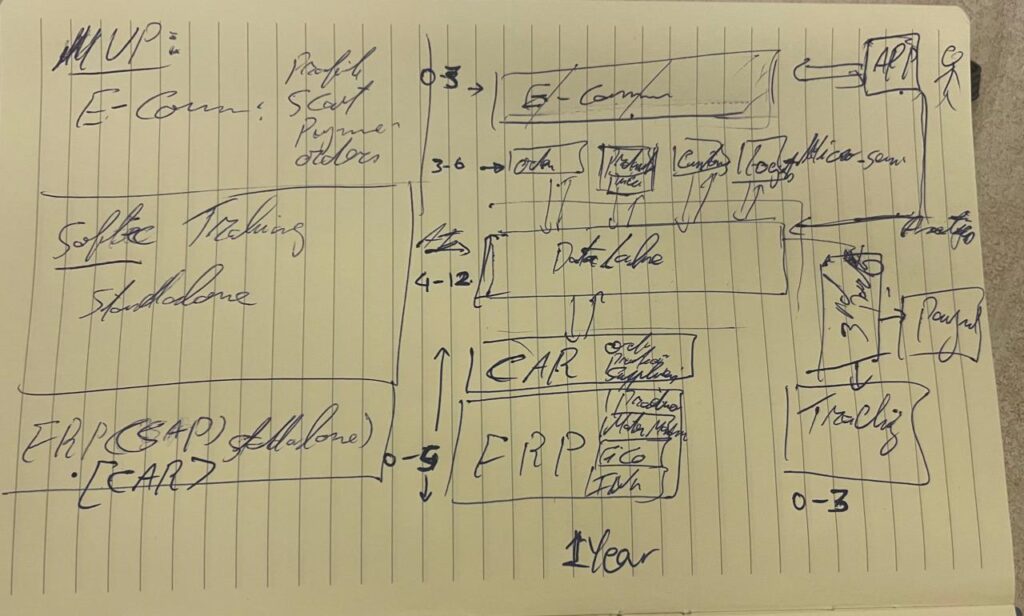

As soon as the “MVP sketch” was in place, we started building the team. People are the greatest asset a company can have. The company’s success was 100% dependent on who we hired to build it. We weren’t looking for the traditional 9-5 types, we had to search deep in the woods for Rabbits, people with fire in their belly and a sparkle in their eyes. We wanted to play an A game, so we were looking for the A players.

And bit by bit, it all started to come together: an amazing team of extraordinary Rabbits that took our vision to the next level, and embody our values every day.

Looking back now at those (assumed) milestones that kept me up many nights, I am amazed at how each of them came by and passed without anyone batting an eye. The Rabbits ran everything perfectly as if we had been doing this for decades, not literally hours.

Soon enough, it seemed like “another day at the office”.

My Personal Journey

In those early days, I had my own dragon to slay. Although I had done this job for more than 20 years, I needed to wrap my head around this new “start-up” world, with all its buzz words, acronyms and bizarre concepts (for me at least).

Startups were about “growth growth growth, at all costs!”.

It’s all about that “hockey stick” line graph – breaking into the top right.

It’s about #Blitzscaling and crafting stories to support a valuation that is multiples of annualized GMV to raise more capital, to then be poured into growth that plasters over leaky business models and hides bad fundamentals. And do it over and over again.

It was mind boggling! How was this sustainable? I found no (good) answer.

During our early days, we tried a lot of things, threw ideas out and keenly studied what sticks. Our customer acquisition numbers were insane. I couldn’t believe it. And while growth was always our P0, we have always kept an eye on our unit economics.

in the data we could see that not all of our business was healthy, we could spot cohorts of customers that opportunistically hunted for the best deals and jumped off to the next thing, thus diluting our revenues, eroding our margins and blurring the real performance (I believe this is what is meant by burning cash).

It took us 6 months from launch to get our tech and reporting in the right shape to truly understand our core customer segment that was in love with our product. I’ve always believed in the power of data. Data doesn’t lie.

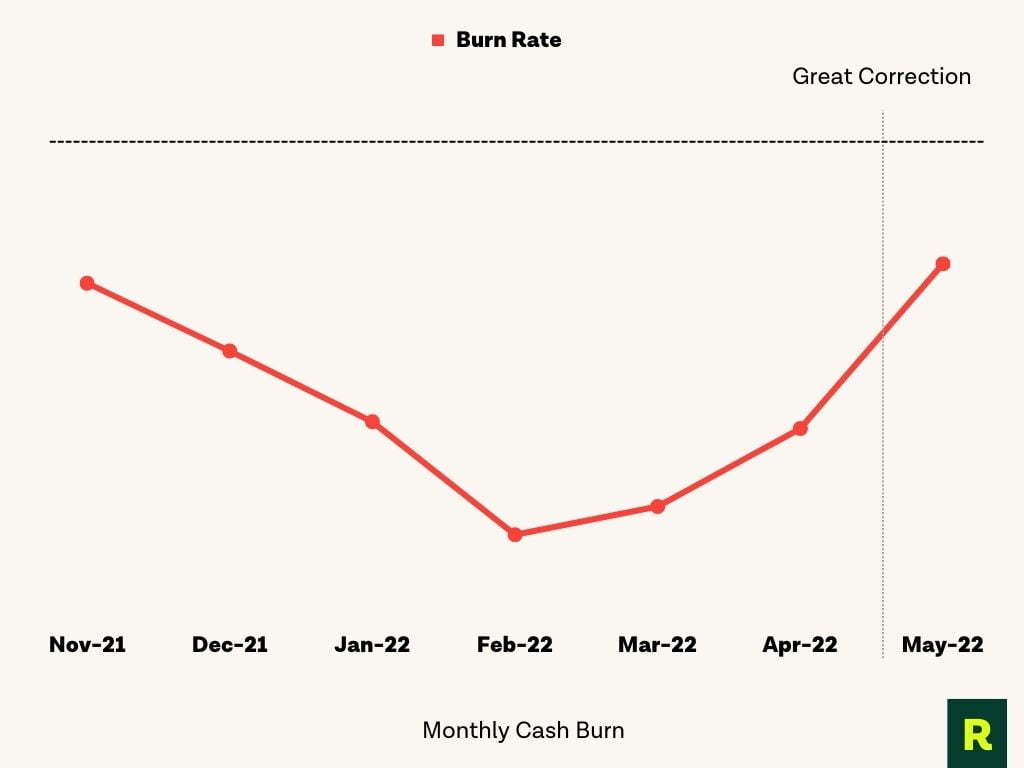

In March, I proposed a radical new shift of strategy that would fundamentally change how we operate. The data made sense, but it was still one of the hardest decisions I was ever part of.

My proposal was to move from growth at all costs to focusing on methodically growing our core user base. This meant that we would deliberately scale down a very young business and bet on our team, brand and unmatched experience to rebuild around the right (and hard to win) segment. If we get it wrong, we lose a lot of valuable time, runway, but if we get it right, we build a much more sustainable and fundamentally sound business.

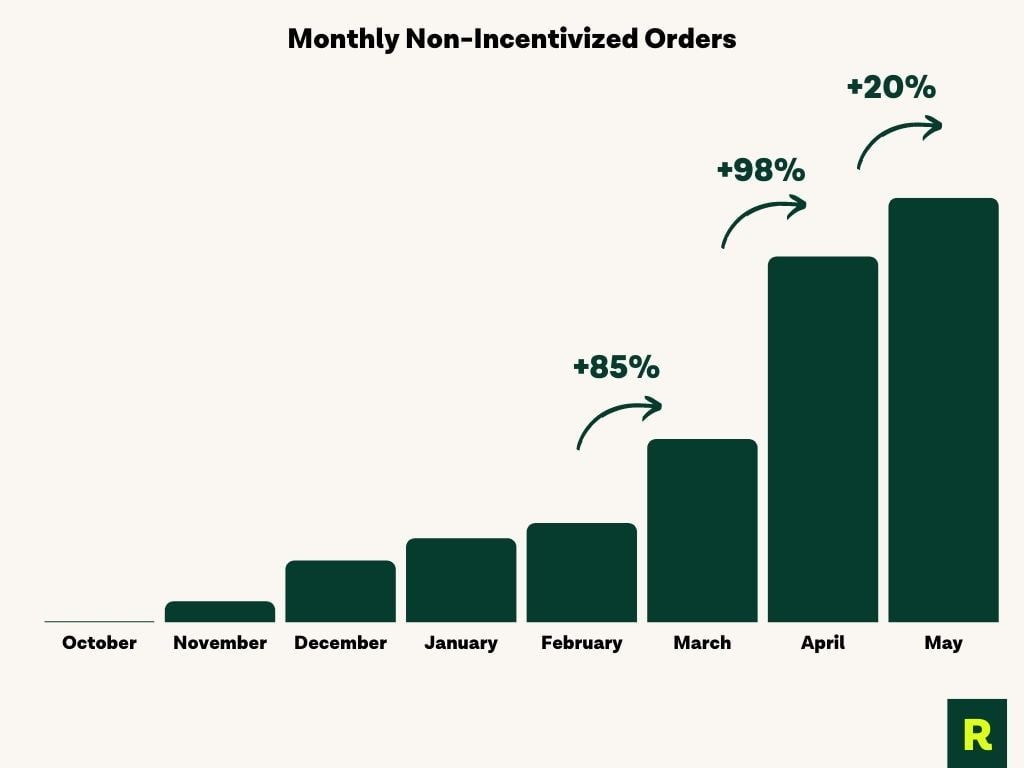

We pivoted in March.

In the weeks to come, we saw a massive difference in all of our core KPIs

- Customer retention numbers jumped to more than +70% (with room to improve even further).

- Active customers were ordering three times as much with an ever growing basket.

- Fresh products penetration of basket jumped two folds

- Our unmatched experience got even better moving from delivering 81% of orders under 20 minutes to 93%

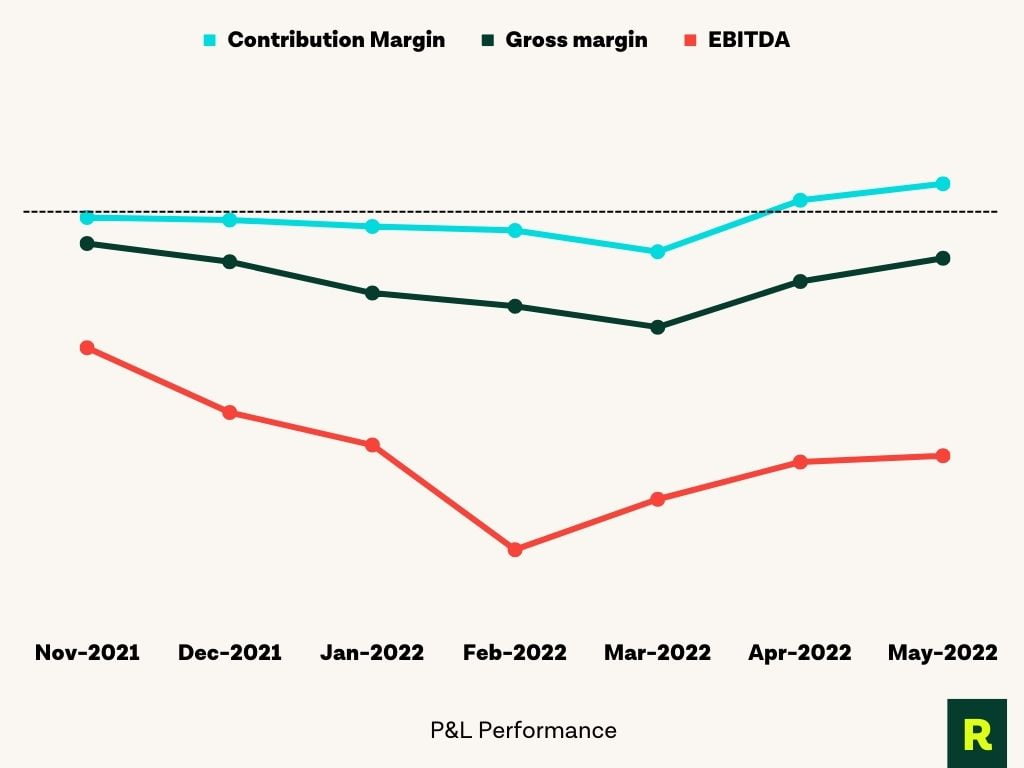

- We also saw a positive step change in our unit economics, improving by +30%

- On the P&L, we reached contribution margin positive and are on track to turning gross profit positive within the coming few months.

It was an uncharted territory, a completely new business. But one that I felt comfortable with, it wasn’t the “growth-at-all-costs startup” way of doing things but a “fundamental startup” approach that is focused on sustainable un-capped growth.

The Great Correction

Around May of this year, the private market took a dramatic downturn following the public market nosedive a few months before. Markets quickly went “risk off”, investments drained up and startups began to feel the heat.

Overnight, the market narrative changed from “grow at all costs” to “turn cash flow positive with the runway you have”.

It is an unfortunate but expected turn of events that would have eventually happened one way or the other. We entered a new era where all new business models, ideas and execution will be put to the test. This would draw a clear delineation between healthy businesses with profit potential that are set to leave their mark on the world, from the cash hungry, solely growth-obsessed ones riddled with bad execution or built on unsustainable models.

While this “nuclear winter” will sadly spell the end of some amazing (and unlucky) companies, I strongly believe that when the dust settles we will have fewer (but stronger) standing startups that will really change the world.

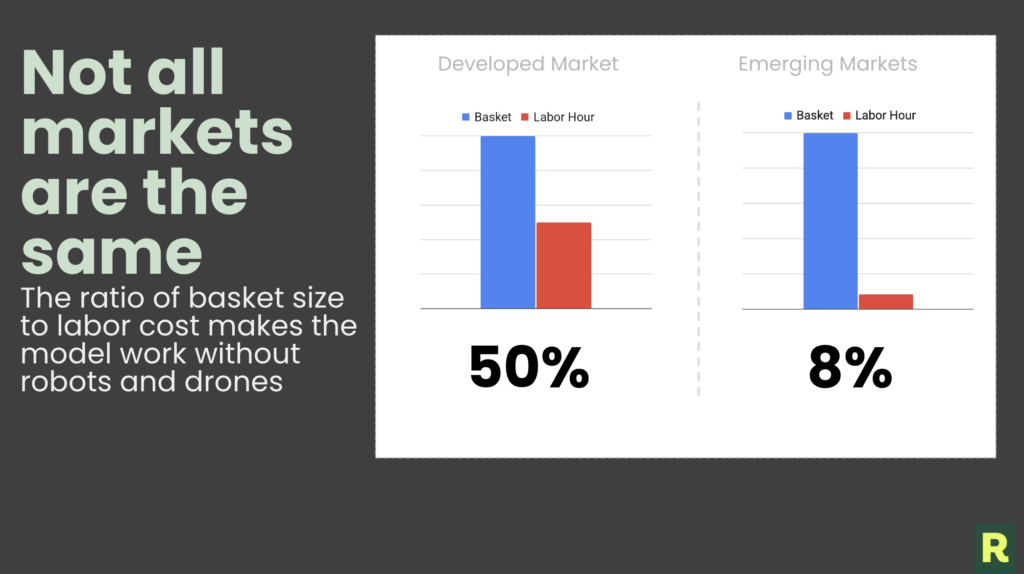

However, I believe emerging markets are more resistant to the volatility of the market conditions due to the arbitrage of relatively higher purchase power to lower labor costs.

Rabbit Year 2

I have boundless confidence that Rabbit will be among those companies leaving their mark on the world.

My confidence stems from a lot of things, to name a few

- Our scary ability to execute, and execute fast.

- Our brilliant A team, our Rabbits are our secret weapon.

- Our epic year 2 strategy, doubling down on our strengths in a bolder and infinitely more exciting way.

- Our solid cash position and current escape velocity are putting us on track to become cash flow positive with runway to spare #SoonDefaultAlive

I know that in a year or two we’ll look back and, for Rabbit, it will have been just “another day at the office”.